Focus - Argentina's Economic Crossroads: Milei's Fight for Stability Amid Crisis

Navigating Inflation, Debt, and Growth: The Challenges and Strategies of Milei's Presidency.

In the aftermath of decades of economic instability and persistent inflation, Argentina's new president, Javier Milei, faces a formidable task: steering the nation towards recovery and long-term stability. Under the previous left-leaning Peronist government, a combination of state-led industrial policies, extensive subsidies, and rigid monetary controls had entrenched high inflation and economic volatility. As Milei embarks on his presidency, his initial successes in curbing inflation have bolstered his popularity, but the road ahead remains fraught with challenges. This article delves into the economic landscape before Milei’s tenure, the initial reforms he has undertaken, and the critical steps needed to secure Argentina's economic future.

The Economic Legacy

Argentina’s left-leaning Peronist government which had dominated politics since 1983, encompasses a diverse array of economic programs, including state-led industrial policies and subsidies for essential goods. This government implemented policies fuelling a persistent high inflation, such as fixing prices and value of argentine peso, subsidised energy and transport and printed billions of dollars to fund a significant deficit.

The monetary policy - The spark of 2001

To combat hyperinflation and boost economic growth, Argentina's Currency Board pegged the peso to the US dollar from 1991 to 2002. During this period, Argentina’s real effective exchange rate appreciated by nearly 80 percent. Initially, the Convertibility plan was deemed successful during the first three years. Indeed, from 1990 to 1993, the appreciation matched the productivity gains following economic stabilization. However, after 1996, a widening gap appeared between the observed real exchange rate and the rate consistent with a sustainable net foreign asset position, indicating that the country was becoming increasingly a net debtor.

By outsourcing its economic policy to the US, Argentina locked itself into a currency regime that gave no flexiblity.

In late 2001, after enduring many months of recession and escalating financial turmoil, Argentina was compelled to abandon its currency board in a move to boost exports. The collapse of the decade-long dollar peg led to an unprecedented financial crisis and a sharp devaluation of the peso. The exchange rate, which had been 1 peso = 1 U.S. dollar during the Convertibility decade, plummeted to nearly four pesos per dollar by mid-2002.

Moreover, the economy is heavily reliant on agriculture (such as wheat and wine) and livestock breeding (particularly beef), making the country highly susceptible to price and climate fluctuations. Successive governments have failed to diversify revenue sources. Part of the income is reinvested in real estate or consumption, while another portion is moved to safer financial markets abroad, further devaluing the peso.

In the two decades following the 2001 crisis, Argentina navigated through economic challenges under left-wing protectionist governments. Their solution to the peso's credibility problem was simply to make it harder to buy dollars and to try to curb the capital outflows by forcing the exporters to bring home their revenues, limiting dividend payments, or forbidding purchasing USD for savings.

As the government struggles to manage its currency and Argentinians witness a decline in their purchasing power, their trust in the local currency diminishes, rendering the US dollar increasingly more appealing. This has led to the emergence of a black market for the US dollar, referred to as the "blue dollar," while banks exhibit reluctance to extend loans to Argentinian companies.

By the time of the 2023 presidential election, there were as many as a dozen different exchange rates, depending on who wanted to access the US currency and why. For the official rate, you needed 287 pesos to buy a dollar, but you could only buy $200 a month and you had to pay punitive taxes on the transaction. After that, it got increasingly bizarre. There was the Coldplay dollar rate (374 pesos to the dollar), especially created for foreign rock bands visiting the country. And there was the Malbec rate (340 to the dollar), designed to boost exports of wine and other agricultural produce.

The social regime

Over a decade of energy and transportation subsidies has eroded Argentina’s fiscal capacity. In the aftermath of the 2001 crisis, tariffs for public services were frozen to mitigate the adverse effects on households' purchasing power. However, these subsidies have steadily escalated since 2006, posing a significant fiscal burden.

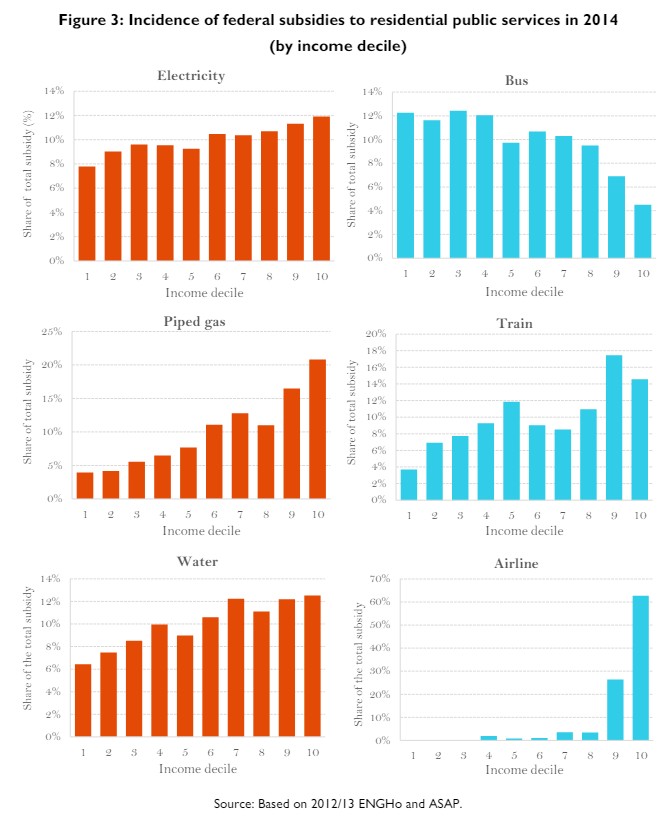

Though subsisdies can be used as a tool to protect the poor, in Argentina, they led to distortions and large share have been absorbed by upper classes. A study from the World Bank Group exhibits this fact. The graph below shows by who, subsidies has been captured. This is most notable with the subsidies to Aerolineas Argentinas, the national airline, which primarily benefit the wealthiest 20% of the population.

The case of the electricity supply is another example of mismanagement. In 2021, authorities implemented unconventional price controls, including those on electricity, to tackle the challenges posed by a new wave of the coronavirus and rising inflation ahead of the midterm elections. Subsidizing the electricity system to control prices is highly expensive. The 2021 budget anticipated that electricity tariffs would stay around 1.8% of GDP, necessitating tariff increases of approximately 30% to 40% throughout the year. However, in May, the authorities approved only a 7% increase. As a result, higher subsidy costs will contribute to the fiscal deficit and necessitate increased financing from the central bank. Morever, the system's costs increased, primarily due to the 48% depreciation of the Argentine peso in 2020 and the increased cost of electricity production.

To avoid depleting its dwindling reserves, the country has borrowed money from Qatar, taken a bridge loan from the CAF development bank, and used yuan from a currency swap with China to make payments to the IMF. While the Central Bank reports that the country has $25 billion in reserves, analysts believe the actual amount is significantly lower.

Fiscal and monetary policies, along with a heavily subsidized economy, led to continuous devaluation of the peso. Before Milei's election, Argentina was grappling with an annual inflation rate of 161%, with 45% of the population living in poverty, and a $110 billion debt to external creditors.

Milei’s Economic revolution - Navigating successes and controversy

The rethoric of the middle-class family, self described “anarcho-capitalist” who claimed his dead dog told him to run for President was proved divisive. He decribed the Pope, an Argentian, as “a leftist son of a bitch” in a country where two-thirds of the population is Roman Catholic.

Clearly, Milei’s eccentric rhetoric is a strategy to draw attention, as his primary goal is to repair the economy and control inflation through dollarization, market deregulation, and austerity. Voters recognize that a significant political shift is necessary to achieve these economic changes.

However, his party, 'La Libertad Avanza,' has held less than 15% of the seats in the lower house. Few days after taking office, on December 20th, Milei utilized a 1994 constitutional mechanism that allows the president to bypass Congress and issue emergency decrees. Among these measures were steps to privatize Argentina’s state-owned companies, including the Aerolineas Argentinas, media companies, and the energy group YPF, as well as reducing regulations on credit cards and lifting restrictions on private healthcare provision. Additional measures targeted labor rights, such as limiting severance pay, reducing maternity leave before birth, and permitting companies to dismiss workers who participate in strikes in a country where unions hold significant power. However, the courts blocked these measures, ruling that the decree did not meet the standard of an emergency and was therefore unconstitutional. The administration has appealed this decision, but the Senate voted to reject the decree, marking Milei's first political defeat.

After six months of his presidency, he has relied exclusively on executive power to implement the austerity measures and deregulation he believes are essential to resolving Argentina's severe economic crisis. After few days in charge, he reduced the number of ministries from 18 to 9 and chose not to renew the contracts of 70’000 of public employees. He decreased subsidies to transport companies and discretionary funding for provinces. He has halted previous governments’ use of money printing to fund spendings and interest payments, pursuing an extreme austerity programme.

Consequently, Argentina is experiencing its most severe economic crisis in two decades. The economy contracted by 3.6% in the first two months of 2024 compared to the same period last year, with a significant drop in consumer spending. The Peso was devalued by 54% in December, causing annual inflation to skyrocket to 287%. Grocery prices have reached levels similar to those in European capitals, despite much lower wages in Argentina. The average salary has decreased by 19% in real terms since December, now standing at 619,000 pesos ($708), which is below the poverty line. Both supermarkets and small retailers have reported annual sales declines of 11.4% and 25.5%, respectively, according to industry groups.

Despite the current hardships, investors and analysts argue that the economic pain was inevitable in 2024 and predict a turnaround. Despite retreating from his campaign promises to dollarize the economy and abolish the central bank, Javier Milei's initial actions have been positively received by the International Monetary Fund (IMF). In January, the IMF demonstrated its support by disbursing $4.7 billion in loans, as it forecasts 5% growth next year, after a 2.8% contraction for 2024.

Milei's administration has celebrated a series of economic victories:

the dollar-denominated sovereign bond prices have nearly doubled

the inflation, which peaked at 26% in December, decreased to 20% in January, 13% in February, 11% in March and 4.6% in June

exports of mining and agricultural goods, boosted by Milei’s devaluation and removal of export restrictions, soared. For example, Argentina exported more meat in February than in any month since 1967.

in April, Milei announced Argentina's first-quarter fiscal surplus since 2008, eliminating the public sector deficit - a huge adjustement of more than 4.5% of GDP.

However, despite these surprising early economic and fiscal successes, sustaining this fiscal surplus is becoming increasingly difficult as the recession, primarily driven by sluggish domestic consumer spending, impacts tax revenue.

Additionally, Milei continues to face challenges in stabilizing the Peso as he tries to control inflation at all costs. In July 2024, the central bank will implement stricter regulations on money printing to reduce Argentina’s money supply. Concurrently, it will begin utilizing its limited foreign currency reserves to purchase pesos on the parallel market. This decision has been widely criticized, as it raises the risk of the government defaulting on over $9 billion in foreign currency debt repayments due next year. Investors are now concerned that the government’s singular focus on controlling inflation is overshadowing other vital components necessary for long-term growth. These components include removing currency controls, accumulating reserves, and securing access to international capital markets. The slow currency devaluation policy is hurting exports’ competitivness.

It seems that the fall in the economy has been in majority normalized, as it will eventually return to growth. Milei's success in curbing inflation has sustained his popularity, which remains steady at around 51 percent, according to Shila Vilker, director of pollster Trespuntozero. However, the greatest threat to this recovery is the potential decline in Milei's support. If opposition increases, either through street protests or in Congress, it could restrict Milei's ability to stabilize the economy.

Following numerous successes in the initial phase of his presidency, Milei should now prioritize economic recovery by improving the external sector balance and aiming for long-term stabilization. To achieve this, the government must ensure the central bank's independence, allow the official currency to adjust to a more realistic level, and adopt a more flexible official exchange rate mechanism. This would enable the central bank to implement a genuine interest rate policy. Analysts note that the government is heavily relying on the hope that the IMF will agree to provide Argentina with additional funds to help lift currency controls. This negotiation and the support from the IMF will be essential for breaking free from decades of instability and economic turmoil.

Thanks for reading Arno’s Substack! Subscribe for free to receive new posts and support my work.

(1) FT - Javier Milei scores legislative victories in Argentina’s lower house

https://www.ft.com/content/170af35f-4315-4725-b358-b466ff3ef34b

(2) FT - Argentine households face financial crunch as markets cheer Javier Milei

https://www.ft.com/content/ca038001-731a-48d6-8719-1d6a5699a29c

(3) AS/COA - A Status Check on President Javier Milei's Policy Proposals https://www.as-coa.org/articles/status-check-president-javier-mileis-policy-proposals

(4) Al Jazeera - First 100 days: Milei falters on shock therapy for Argentina’s economy

https://www.aljazeera.com/economy/2024/3/19/first-100-days-milei-falters-on-shock-therapy-for-argentinas-economy

(5) IMF - Datamapper

(6) FT - High febt levels put Europe at risk of “adverse shockes”, ECB warns https://www.ft.com/content/9c2dad74-e3bb-4c8c-b190-41cf2e838dde

(7) Herodote - Instable Argentine 2003-2023 : heurts et malheurs du kirchnérisme https://www.herodote.net/Instable_Argentine-evenement-20011220.php

(8) World Bank Group - The incidence of subsidies to Residential Public services in Argentina: The subsidy system in 2014 and some alternatives. https://documents1.worldbank.org/curated/en/435261471340419978/pdf/107852-WP-P155167-PUBLIC-TheIncidenceofSubsidiesinArgentinaFINAL.pdf

(9) Enrique Alberola, Humberto López and Luis Servén - Tango with the Gringo: The hard peg and real misalignment in Argentina - World Bank Policy Research Working Paper 3322, June 2004

(10) Fitch ratings - Unsustainable Argentine Electricity Subsidies Raises Cash Flow Risk - https://www.fitchratings.com/research/corporate-finance/unsustainable-argentine-electricity-subsidies-raises-cash-flow-risk-01-06-2021

(11) Buenos Aires Herald - Government halts transport subsidies, discretionary funds to provinces - https://buenosairesherald.com/politics/government-halts-transport-subsidies-discretionary-funds-to-provinces